Check Today's Gold Price

02 April 2025

Gold Price Table

| Period | Buy Price | Sell Price |

|---|

Why Nanovest Gold?

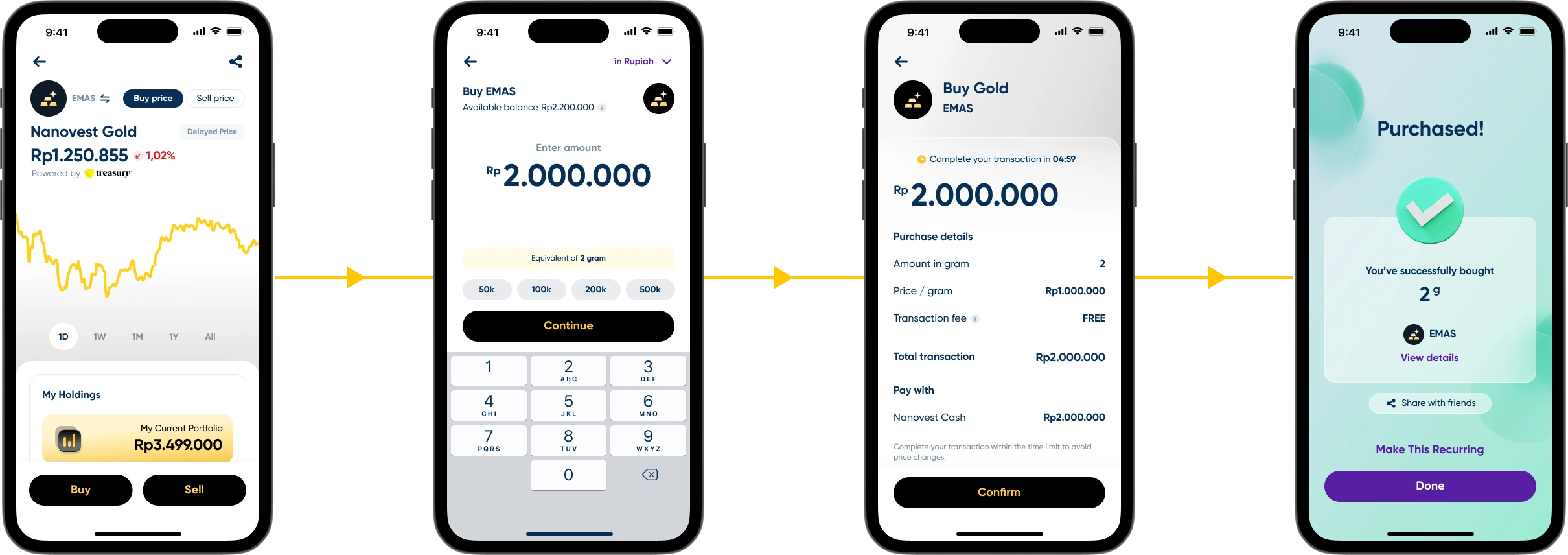

Investing made easy in few steps

Frequently Asked Questions

Nanovest Gold is a digital gold investment product in collaboration with PT Indonesia Logam Pratama (“Treasury.id”) so that you can protect your wealth by investing in safe asset.

The security of your assets is our priority. Nanovest collaborates with PT Indonesia Logam Pratama (“Treasury.id”) as the first digital physical gold trader licensed by BAPPEBTI.

With Nanovest Gold you can diversify your investment portfolio starting from IDR 5,000 with real-time prices and supported by Treasury.id

You can follow these steps to buy gold at Nanovest:

- Open the Nanovest application

- Go to the Nanovest Gold page

- Click Buy

- Enter the amount of gold purchased. At this stage, there are two options for purchasing gold that you can use, namely, purchasing in Rupiah and purchasing in Gram

- Confirm purchase. After you have checked the purchase details and ensured that the balance is sufficient, you can confirm the purchase

- Enter your PIN. You will authorize the transaction once the PIN is entered. You have 4 chances to enter your PIN, so make sure you have the correct PIN code

- Gold purchase was successful

There is no time limit for making transactions, purchases can be made 24/7.

Explore More

Key Factors Influencing Gold Price Fluctuations

For many, gold is more than just a shiny metal suitable for jewelry. It is one of the oldest and most popular investment assets in the world. Why? Because its value is considered a safe haven amid economic turbulence, changes in monetary policy, and political instability.

But have you ever wondered why gold prices can swing as wildly as a roller coaster? What exactly influences the price of gold? Below, we’ll uncover the key factors that drive these frequent changes.

1. Global Economic Conditions

Global economic conditions play a significant role in determining gold prices. During periods of global instability, such as recessions, financial crises, or even geopolitical tensions, many people seek safe havens to store their wealth.

Conversely, when the global economy is thriving, investors tend to prefer assets with higher returns, such as stocks or real estate. This can reduce demand for gold, subsequently lowering its price. In this way, global economic conditions are like the “weather” for gold: when it’s sunny, prices drop; when it’s cloudy, prices rise.

2. Monetary Policy and Interest Rates

Monetary policy set by central banks, such as the Federal Reserve (the U.S. central bank), also has a major impact on gold prices. One of the most influential policies is interest rates. When interest rates rise, people are more likely to save money in banks due to the attractive returns from interest, rather than holding gold, which doesn’t yield interest. As a result, gold prices tend to drop.

On the other hand, when interest rates are low or even negative, gold becomes more appealing because other assets no longer offer attractive returns. This increases demand for gold, driving its price upward. Similarly, monetary easing policies, such as printing new money, can lead to higher inflation, and gold is often seen as a hedge against inflation.

3. Global Supply and Demand

The basic laws of supply and demand influence all prices, including gold. Gold demand comes from various sectors, ranging from jewelry and investment to its use in technology, such as electronic devices. On the supply side, gold production from mines and the amount of gold circulating in the market both play a role.For instance, during wedding seasons in India or festivals in China, gold demand typically increases, driving prices higher. India and China are two of the largest gold-consuming nations in the world. If gold mines face challenges in increasing production or there are disruptions in supply chains, the reduced supply can also push prices higher.

4. Currency Exchange Rates (USD vs. Gold)

When the U.S. dollar strengthens against other currencies, demand for gold tends to decline as people shift their assets to other instruments. From a local currency perspective, more local currency is required to exchange for U.S. dollars, making gold prices in local currency terms appear more expensive. This weakens gold demand.

Conversely, when the U.S. dollar weakens, demand for gold rises, and its price tends to increase. From the perspective of local currencies, fewer local currency units are needed to exchange for U.S. dollars, enabling people to acquire more gold. This situation strengthens demand for gold.

5. Market Sentiment

Although it may sound abstract, market sentiment has a significant influence on gold prices. Market sentiment refers to investors’ feelings or expectations about future economic, political, or financial conditions. When market sentiment is optimistic, investors are more likely to invest in riskier assets like stocks that offer higher returns.

On the other hand, when market sentiment is pessimistic or uncertain, gold becomes a preferred choice as a safe-haven asset, causing its demand and price to increase.

Gold Investment Tips

Before deciding to dive into the world of gold investment, there are several things to keep in mind to avoid buying recklessly and ending up with losses. To maximize your returns and minimize risks, here are some practical tips to guide you toward smarter gold investing.

1. Define Your Investment Goals

The first thing to consider before starting a gold investment is defining your investment goals. Are you investing for the long term as a future savings plan, a retirement fund, or simply to hedge against inflation? Defining your goals is essential, as it will determine your investment strategy and duration.

If your goal is long-term, you might not need to stress over short-term price fluctuations. However, if it’s for short-term purposes, your strategy will likely differ, focusing more on timing your buying and selling decisions.

2. Monitor Global and Local Gold Prices

Although gold is a global commodity, local gold prices are also influenced by factors such as the exchange rate between the Indonesian Rupiah and the US Dollar, as well as local government policies. Therefore, it’s crucial to keep an eye on both global and local gold prices before making a purchase.

Local gold prices often differ from global gold prices due to variations in domestic demand and supply. This is understandable, as gold is traded worldwide, with some countries having their own gold mines and selling locally.

Despite these differences, local gold price trends generally follow global trends. Make sure to purchase gold when its price is reasonable and not excessively high compared to international trends.

3. Buy Gold When Prices Drop or Stabilize

This may sound cliché, but one of the most fundamental gold investment tips is to buy when prices are low or at least stable. Much like stock investments, the principle of buying gold at a low price and selling at a high price applies here too.

Regularly monitoring gold price movements can help you identify the best time to buy. If the latest gold prices are declining due to stable or positive global market conditions, this could be a good opportunity to buy before prices rise again.

4. Diversify Your Investment Portfolio

Even though gold is considered a relatively safe asset, it’s still important not to put all your capital into one type of investment. Diversifying your portfolio is key to reducing risk. In addition to gold, ensure you have other assets in your portfolio, such as stocks, bonds, or mutual funds.

Diversification helps protect your portfolio from significant losses if one asset experiences a drastic decline. By balancing your portfolio, you can spread and manage risks more effectively.

5. Use the Dollar Cost Averaging (DCA) Strategy

The Dollar Cost Averaging (DCA) strategy involves regularly purchasing gold in fixed amounts, regardless of price conditions at the time. The advantage of DCA is that it allows you to avoid the psychological effects that often cause investors to panic when prices drop.

With DCA, you consistently buy gold whether prices are rising or falling, resulting in a more stable average purchase price. This strategy is ideal for long-term investors who want to mitigate short-term price volatility.

The good news is that platforms like Nanovest offer a recurring buy feature, allowing you to schedule routinely and automatically purchases of digital gold.

6. Stay Updated on the Latest Gold Prices

Gold prices can change daily, even hourly, depending on global economic conditions, monetary policies, or market sentiment. Therefore, it’s important to stay updated on the latest price movements before making buying or selling decisions. By staying informed, you can make smarter decisions about the best times to buy or sell gold.

Why Choose Digital Gold?

With advances in technology, digital gold has emerged as a modern alternative to traditional gold investments. This innovation makes investing in gold simpler, hassle-free, and accessible directly from your smartphone. Digital gold is becoming increasingly popular as it offers various benefits tailored to modern lifestyles, especially for millennials and Gen Z. Curious why digital gold might be the smart choice? Let’s dive in!

1. A Hedge Against Inflation

Like physical gold, digital gold serves as a hedge against inflation. When the prices of goods and services rise, gold tends to retain its value. This is because gold is globally recognized as a safe asset during times of economic uncertainty.

So, when cash or other investments lose value due to inflation, gold often holds steady—or even appreciates. The difference with digital gold is that you don’t have to deal with the hassle of storing physical gold, yet you still enjoy its value-preserving benefits.

2. High Liquidity

Digital gold offers high liquidity, meaning you can cash out your investment anytime, anywhere, hassle-free. Unlike physical gold, which may require you to visit a specific store or location to sell, digital gold can be sold instantly through the app or platform you’re using. This makes it far more flexible and convenient, especially in times of urgent financial need. High liquidity is undoubtedly an advantage, particularly in times of emergency.

3. Portfolio Diversification

One of the basic principles of investing is not putting all your eggs in one basket. Digital gold can be an excellent option for diversifying your investment portfolio. This means you’re not solely investing in one asset type, such as stocks or bonds, but also in gold.

Diversification is crucial to mitigate risk because if one asset in your portfolio declines in value, the stability of gold can help maintain balance. In this sense, digital gold can act as a “safety net” when other investments are underperforming.

4. No Need for Physical Storage

One of the biggest challenges of investing in physical gold is storage. Keeping gold bars or coins at home can be risky, while renting a safety deposit box at a bank incurs additional costs. With digital gold, storage is no longer a concern. All the gold you purchase digitally is stored securely by authorized institutions that guarantee its existence and verification. It’s practical, safe, and doesn’t take up any physical space, right?.